Commercial Real Estate: Commercial Real Estate Under the Biden Administration

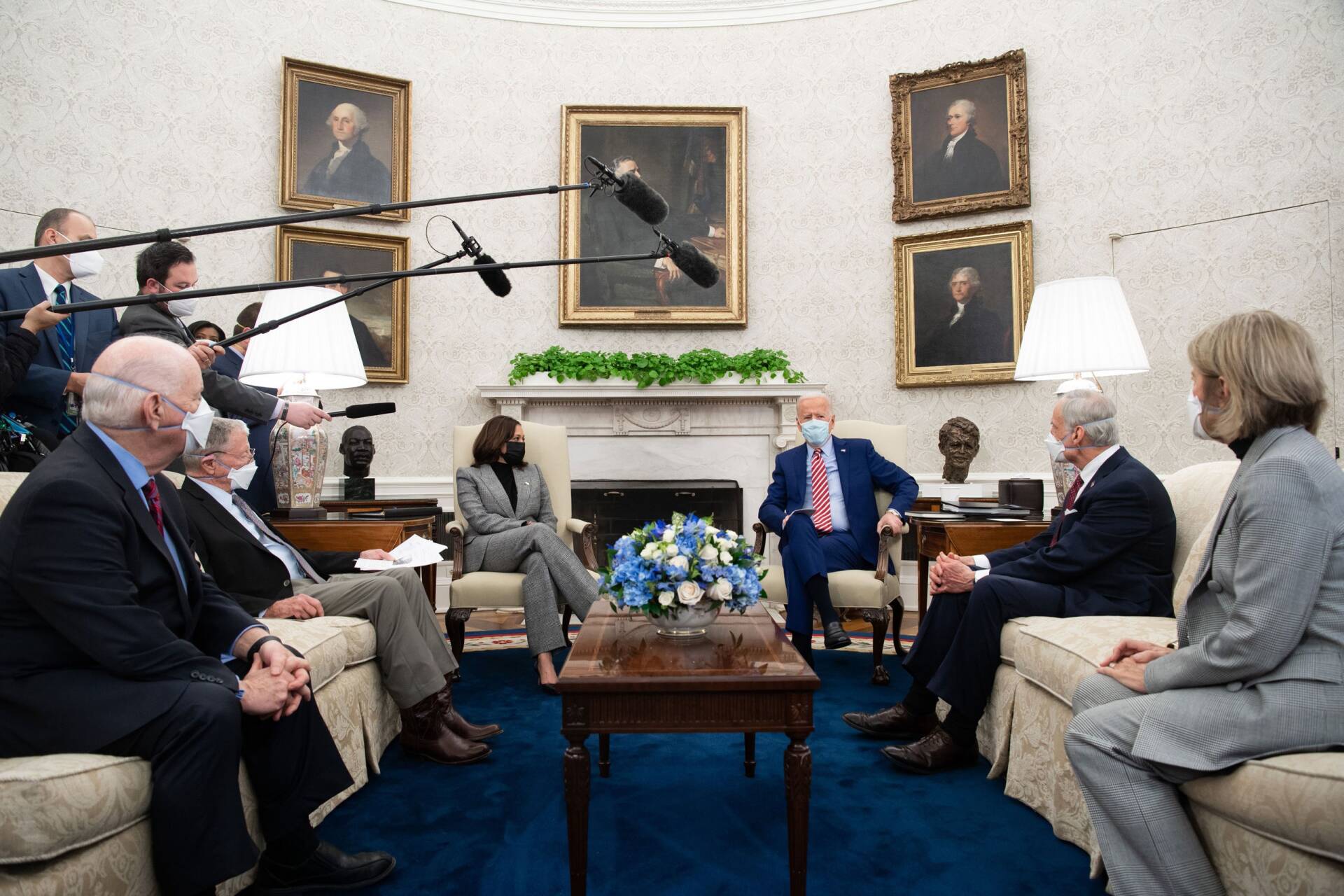

Now with victories in Georgia giving Democrats control of the senate, it seems quite likely that this plan will go forward.

What will overhauling American infrastructure and introducing rapid transit into small cities mean for commercial real estate? We’ve already seen smaller markets become more attractive for residents and employers, able to move thanks to work from home infrastructure.

Covid-19 and the National Mask Mandate

But the overwhelming focus for the Biden Administration will be to corral the coronavirus. Biden has assumed the presidency with Covid-19 at surging levels.

Biden may call for a national mask mandate—which should not affect CRE other than for building owners to oversee compliance. Beyond that, he is already putting together a task force of experts and it is unclear what they might recommend.

Biden has said on the campaign trail that he does not want to shut the economy down, but it is within the realm of possibility that he might try to persuade local governments in hot spots to temporarily close areas to prevent further spread. The latter move, of course, will have an affect on local real estate just as it did in the Spring when much of the nation closed down.

In the bigger picture, a national-led effort to push back against the virus will hopefully drive down infections enough until a vaccine becomes more available. This can only help CRE as it is clear that the economy will not fully recover until the coronavirus is vanquished.

Commercial Real Estate: CRE Depends Less on Political Parties

It is a general rule that CRE performance depends more on macroeconomic and asset class fundamentals than which political party is in charge of the White House and Congress.

A report from Newmark Group, for example, has found that over the past 40 years, annualized total returns averaged 9% under Democratic presidents and 8.2% under Republican presidents.

“The outside events that are not directly controlled by American public policy, tend to have a much greater impact on the commercial real estate market than the specifics that come out of Washington,” Sandy Paul, senior managing director of national market research at Newmark Knight Frank’s Washington DC office.

What’s different this election cycle is that an outside event—namely Covid-19—is the dominant trend now shaping how CRE performs and the policies put in place by the Biden Administration could go far in determining the final outcome.

Investors Need to Sit Back and Wait

Clearly, Joe Biden's plans are a bit of a mixed bag for real estate investors. But one thing to remember is that once he takes office, Biden won't operate in a bubble.

He'll still need the support of Senate lawmakers to institute tax code changes, so it may be quite some time until his proposals actually come to light, if they happen at all. As such, real estate investors should keep Biden's proposals in mind, but shouldn't necessarily celebrate them, or panic, just yet.

How Real Estate Became a Billionaire Factory

You probably know that real estate has long been the playground for the rich and well connected, and that according to recently published data it’s also been the best performing investment in modern history. And with a set of unfair advantages that are completely unheard of with other investments, it’s no surprise why.

But those barriers have come crashing down - and now it’s possible to build REAL wealth through real estate at a fraction of what it used to cost, meaning the unfair advantages are now available to individuals like you.

Real Estate Matrix is one of the Southeast’s premier commercial valuation firms and has participated in the valuation of billions of dollars in real property assets.

We would appreciate the opportunity to add you to our very long list of pleased clients. You can give us a call or click here to fill out our Free Quote Appraisal Form.