Commercial Real Estate: The Impact of COVID-19 on the Hospitality Industry

The impact of COVID-19 on our lives and economy has been vast. It has affected just about every industry and the hotel industry is among the hardest hit.

Quick Facts:

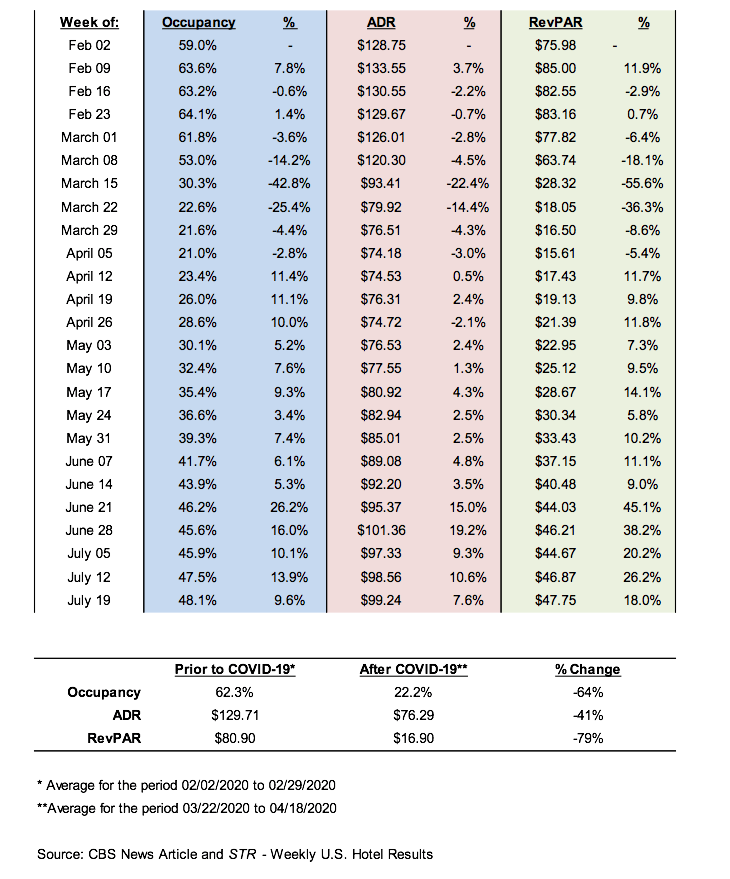

- As of July 30th, more than half open hotel rooms were empty across the country. This is in addition to the thousands of hotels shuttered completely.

- Since the public health issue began escalating in mid-February in the U.S., hotels have already lost more than $46 billion in room revenue.

- The human toll is equally devastating with major hotel managers already reporting significant layoffs and furloughs.

- The Bureau of Labor Statistics reported that 4.8M hospitality and leisure jobs have been lost since February.

- Individual hotels and major operators are projecting occupancies below 20%. At an occupancy rate of 35% or lower, hotels may simply close their doors, putting 33,000 small business at immediate risk.

- STR reported that in May, U.S. hotel operating profits fell by 105% compared to last year, meaning that hoteliers simply have no revenue to pay their costs.

Travel at a Standstill

Travel halted in late February, the hotel industry took immediate action to work with the White House and Congress to help hotel industry employees and small business operators, which represent 61 percent of hotel properties in the U.S.

On average, full-service hotels are using 14 employees, down from 50 before the crisis. Resort hotels, which often operate seasonally based on the area’s peak tourism months, averaged about 90 employees per location as recently as March 13, are down to an average of five employees per resort today.

Six in 10 leisure travelers have canceled a planned vacation as a result of COVID-19, one in three travelers has postponed vacation plans in hopes of rescheduling later in the year, according to the Travel Intentions Pulse Survey.

Hilton CEO says Recovery is Two to Three Years Away

Despite a relatively quick ramp-up in system wide occupancy over the summer, Hilton Worldwide CEO Chris Nassetta said he expects recovery trends to moderate come fall, as leisure travel demand tapers off and economic pressures intensify.

Nassetta comments he expects it will take "two or three years to get back to demand levels experienced in 2018 or 2019."

Occupancy across the company's global portfolio is currently at approximately 45%, versus a low of around 13% in April. The rate was bolstered primarily by increased demand for limited-service hotels and drive-to leisure markets.

96% of Hilton's systemwide hotels have remained open.

Areas of Recovery

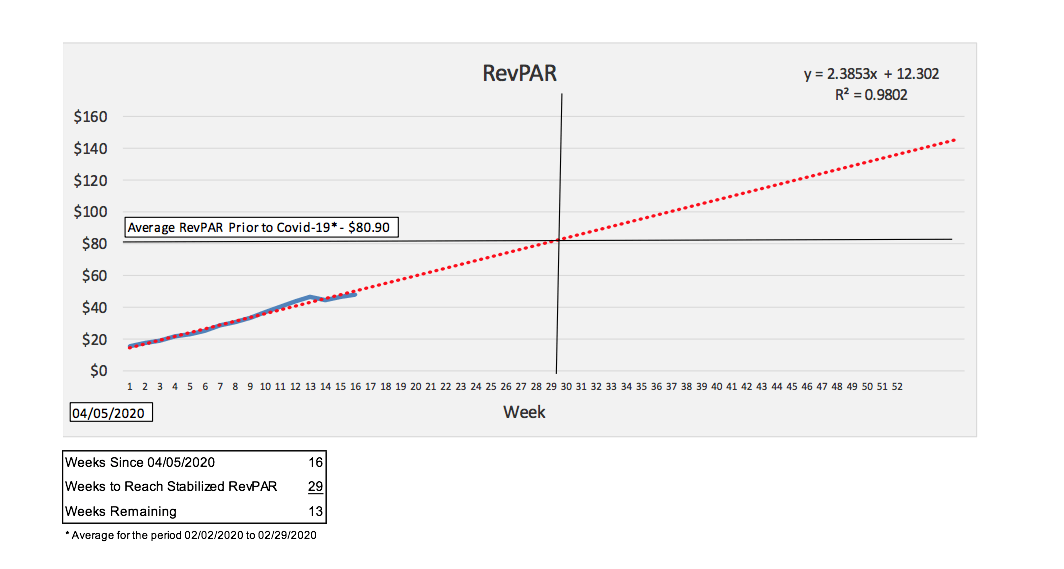

The unknown timeframe of the pandemic creates uncertainty for recovery.

Many factors impact when recovery can begin such as the discovery of therapeutics and/or a vaccine. Also, social distancing requirements following the current stay-at-home environment.

Leisure travelers are likely to be the first guests that initially come back to hotels.

Staycations are expected to be the largest uses of hotel rooms in the early months post-pandemic. Additionally, business travel is expected to return depending on businesses’ available budgets for travel.

Uncertain and Quick Change is Ahead

Prior to the downturn from COVID-19, the hotel market performance was already softening. However, low interest rates sustained acquisitions and refinancing of hotel assets.

If interest rates remain low, investment demand for hotel assets may drive lower equity yields, resulting in quicker and more exponential growth of value.

There is definite uncertainty about recovery timing, experts say it could take years.

The hotel industry is at a critical juncture, they will need resources to survive. Additional funding is vital for the tens of thousands of small business hoteliers. They will need funding to help them to keep their doors open and rehire employees.

Real Estate Matrix is one of the Southeast’s premier commercial valuation firms and has participated in the valuation of billions of dollars in real property assets.

We would appreciate the opportunity to add you to our very long list of pleased clients. You can give us a call or click here to fill out our Free Quote Appraisal Form.